“The more that financial education initiatives are developed, both in and outside of school, the more important it is for governments and other stakeholders to evaluate and prioritize such initiatives and to scale and spread good practice.” — Andreas Schleicher

To thrive in today’s innovation-driven economy, students need a different mix of skills than in the past. Experts believe that educating kids to be financially literate and manage their own finances is one of them. It is also the best way to ensure young people can manage money and even more important, are able to spend it wisely.

So how financially literate is your 15 year-old? The OECD has just released its latest study of the financial literacy competencies of 15 year-old students in 15 countries. Which countries do well and what can we learn from them?

The Global Search for Education caught up with Andreas Schleicher, Director of the OECD Directorate for Education and Skills, to discuss the latest findings.

Andreas, welcome back. In this study, what were the key questions asked to determine financial literacy?

We tested whether 15-year-olds were able to define their priorities and plan what to spend money on; whether they are aware that some purchases have ongoing costs or that they can become the victims of fraud; and to know what risk is and what insurance is meant for. Some of the questions also required knowledge of basic financial instruments, such as a bank account.

“We should look for complementarities, where financial education becomes a context that helps make learning in traditional school disciplines more relevant and interesting.” — Andreas Schleicher

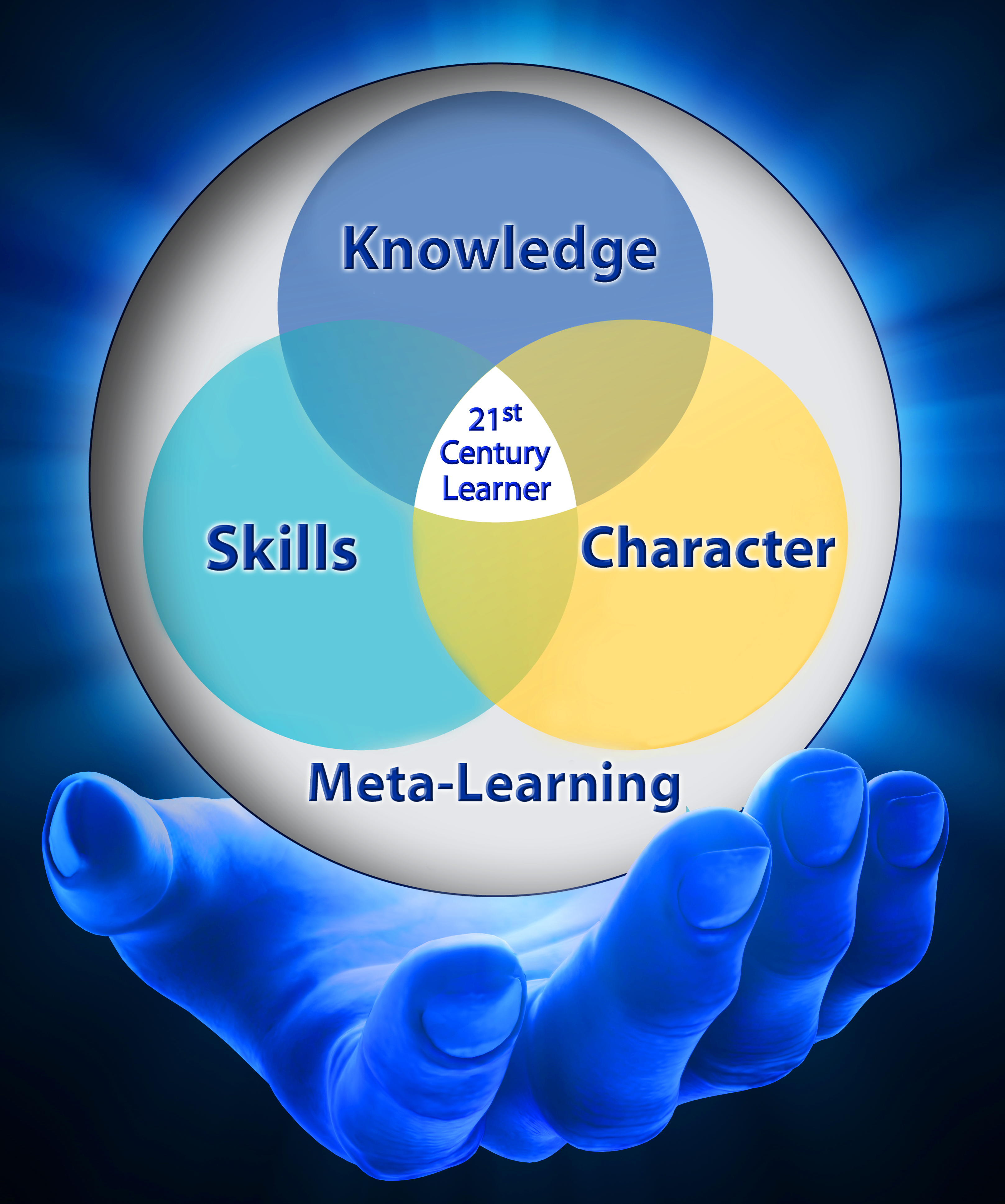

Clearly this is a key knowledge area for practical competence in the real world. How extensive does the focus on this competency need to be in 21st curriculum?

Well, everywhere, people face more challenging financial choices. The spread of digital financial services opens up new opportunities for people once excluded from the financial system; but the digitised system also exposes consumers to new security threats and risks of fraud that are compounded when low financial literacy is combined with poor digital skills and ignorance of cyber security. There are also greater financial risks. Increased life expectancy, more individualised pensions, and more uncertain economic and job prospects due to digitalisation, technological change and globalisation are just some of these. Last but not least, growing inequality means that those with poor skills face particular risks.

Think about it: two in three 15-year-old students earn money from work activity, and more than one in two hold a bank account. And yet, among students in OECD countries who took the 2015 PISA test in financial literacy, fewer than one in three of them reached Level 4 on the assessment – the level that signals the kinds of knowledge and skills that are essential for managing a bank account or a financial task of similar complexity. And the demands on their financial skills rise as students get older: 79% of Australian students took out a public loan in 2013; in the Netherlands, students graduate with an average debt of US$18,000.

Good literacy and numeracy skills, the capacity to think critically and to solve complex problems but also have sound knowledge of financial instruments will be key. At least it is one side of the coin. The other will always be adequate consumer protection.

“PISA results show that when students discuss money matters with their parents, they have significantly higher financial literacy skills, even after accounting for differences in socio-economic background and their performance in other subjects.” — Andreas Schleicher

Do you have views on how to integrate this into other areas of curriculum without further overloading student time commitments?

Yes, that is a fair point, but educators should not see this as a zero-sum game, where more financial education will necessarily take something away from the rigor, focus and coherence that is needed to give students strong foundations in mathematics or reading. We should look for complementarities, where financial education becomes a context that helps make learning in traditional school disciplines more relevant and interesting. We already find good examples of this in Australia, Belgium, Canada, Lithuania, Peru, the Slovak Republic and the United States.

What are the most effective practices you have seen to imparting financial literacy among the PISA participants?

Actually, the best predictor is strong performance in key subject disciplines like math and reading, so doing a good job with foundation skills is an important starting point. But it requires more than that. The PISA financial literacy assessment reveals that 38% of the variation in financial literacy is not explained by mathematics and reading skills. Many features of financial literacy are unique to the subject. These include being aware that some deals really are too good to be true, understanding the role of income tax, being vigilant for fraudulent e-mails, and knowing one’s rights and responsibilities in the financial marketplace. It is also interesting to see that some countries do much better in financial literacy than they do in reading and mathematics. The best example is again the four provinces in China, where students are almost a full school year ahead of what their reading and mathematics performance would predict. The Flemish Community of Belgium, Russia and the Canadian provinces that took part in the test also do better in financial literacy than they do in mathematics or reading.

“Students who are more financially literate are more motivated to use financial products, and perhaps more confident in doing so.” — Andreas Schleicher

Have any of these practices formally involved parent participation, which seems to be a key source for helping their children develop this literacy.

Parents and families play an important role. PISA results show that when students discuss money matters with their parents, they have significantly higher financial literacy skills, even after accounting for differences in socio-economic background and their performance in other subjects. Young people can also learn on their own by using appropriately regulated financial products in a context where young consumers are adequately protected.

The trouble is that all this seems to work just for students from more privileged backgrounds. Advantaged students score the equivalent of more than one PISA proficiency level higher in financial literacy than their disadvantaged peers. That’s equivalent to the difference between being able only to identify a delivery cost that is stated on an invoice and interpreting the various elements of the same invoice to correct a mistake in the billing.

This shows how important it is for schools and school systems to play a role in giving all children a fair chance to succeed. Some school systems already do this very well. Students in the four Chinese provinces and municipalities that took part in the test – Beijing, Jiangsu, Guangzhou and Shanghai – came out well ahead of their peers in every other country. Even more impressive, the socially and economically most disadvantaged quarter of students in these provinces did as well as the second wealthiest quarter of students in the United States, and better than the wealthiest quarter of students in Brazil, Chile and Peru.

Evidence that there is a positive relationship between performance in financial literacy and holding a bank account or receiving gifts of money, all other things being equal, suggests that some kind of experience with money or financial products can provide students with an opportunity to reinforce financial literacy, or that students who are more financially literate are more motivated to use financial products, and perhaps more confident in doing so. Young people can also learn through after-school initiatives. In some countries, governments and not-for-profits are offering young people videos, competitions, interactive tools and serious games via digital and/or traditional platforms.

But the more that financial education initiatives are developed, both in and outside of school, the more important it is for governments and other stakeholders to evaluate and prioritize such initiatives and to scale and spread good practice.

Thanks Andreas.

(All photos are courtesy of CMRubinWorld)

C. M. Rubin and Andreas Schleicher

Join me and globally renowned thought leaders including Sir Michael Barber (UK), Dr. Michael Block (U.S.), Dr. Leon Botstein (U.S.), Professor Clay Christensen (U.S.), Dr. Linda Darling-Hammond (U.S.), Dr. MadhavChavan (India), Professor Michael Fullan (Canada), Professor Howard Gardner (U.S.), Professor Andy Hargreaves (U.S.), Professor Yvonne Hellman (The Netherlands), Professor Kristin Helstad (Norway), Jean Hendrickson (U.S.), Professor Rose Hipkins (New Zealand), Professor Cornelia Hoogland (Canada), Honourable Jeff Johnson (Canada), Mme. Chantal Kaufmann (Belgium), Dr. EijaKauppinen (Finland), State Secretary TapioKosunen (Finland), Professor Dominique Lafontaine (Belgium), Professor Hugh Lauder (UK), Lord Ken Macdonald (UK), Professor Geoff Masters (Australia), Professor Barry McGaw (Australia), Shiv Nadar (India), Professor R. Natarajan (India), Dr. Pak Tee Ng (Singapore), Dr. Denise Pope (US), Sridhar Rajagopalan (India), Dr. Diane Ravitch (U.S.), Richard Wilson Riley (U.S.), Sir Ken Robinson (UK), Professor Pasi Sahlberg (Finland), Professor Manabu Sato (Japan), Andreas Schleicher (PISA, OECD), Dr. Anthony Seldon (UK), Dr. David Shaffer (U.S.), Dr. Kirsten Sivesind (Norway), Chancellor Stephen Spahn (U.S.), Yves Theze (LyceeFrancais U.S.), Professor Charles Ungerleider (Canada), Professor Tony Wagner (U.S.), Sir David Watson (UK), Professor Dylan Wiliam (UK), Dr. Mark Wormald (UK), Professor Theo Wubbels (The Netherlands), Professor Michael Young (UK), and Professor Minxuan Zhang (China) as they explore the big picture education questions that all nations face today.

The Global Search for Education Community Page

C. M. Rubin is the author of two widely read online series for which she received a 2011 Upton Sinclair award, “The Global Search for Education” and “How Will We Read?” She is also the author of three bestselling books, including The Real Alice in Wonderland, is the publisher of CMRubinWorld, and is a Disruptor Foundation Fellow.

Follow C. M. Rubin on Twitter: www.twitter.com/@cmrubinworld

Recent Comments